"Good Afternoon," said by Jerome Powell on Sep 18, 2024. As soon as those words hit, a wave of anxiety spread across the globe.

Federal interest rates have been rising steadily since the global pandemic—over four years of hikes. Although we knew the rate hikes would eventually reach a turning point, the sudden shift caught many off guard. The U.S. Federal Reserve has finally made a drastic move: a 50 basis points (bps) cut.

How will this movement change the global market? What may be our opportunities within this wave?

Why Fed cut Federal Fund rate by 50 Bps

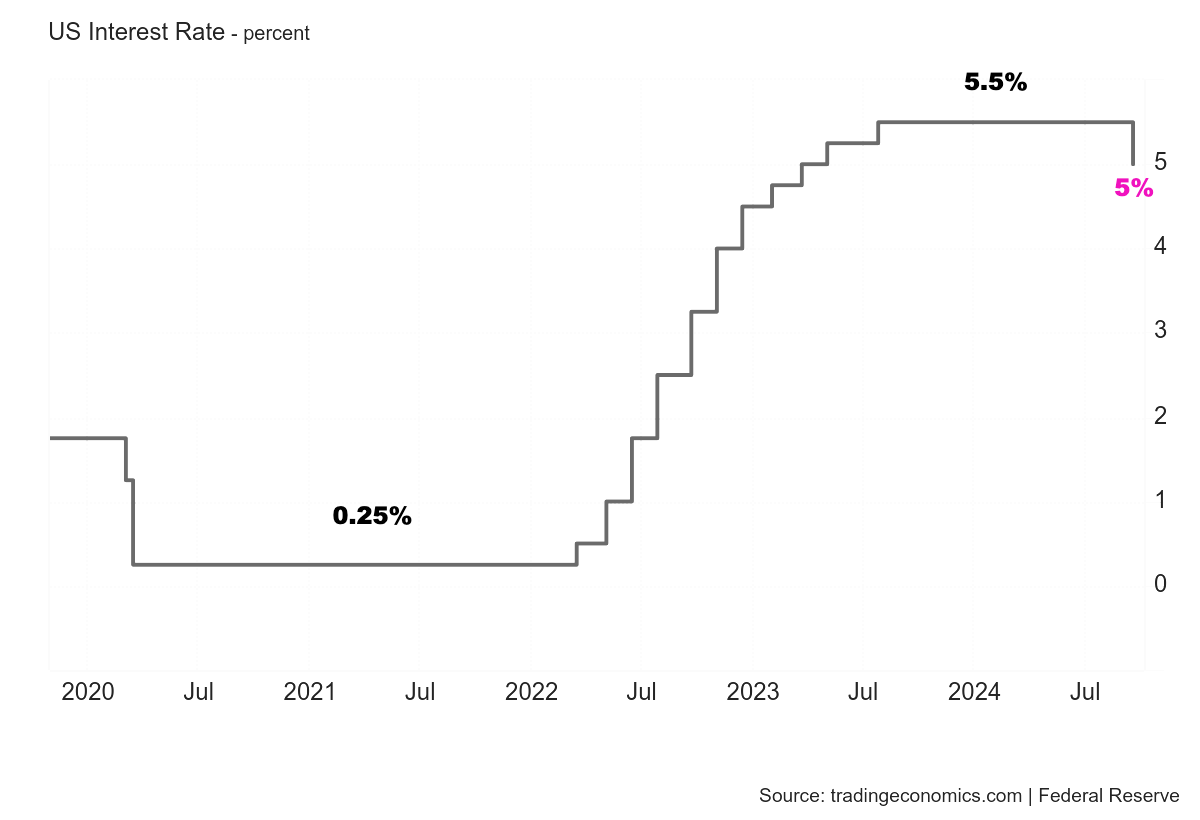

From the transcript of Chair Powell’s Press Conference, we see the goals of the Federal Reserve: maximum employment and stable prices. From the past 4 years, the federal fund rate increased to 5.5% from 0.25%.

How Fed Fund rate adjustments affect Inflation

Inflation represents the general level of prices for goods and services, eroding purchasing power. When inflation is high, we need to pay more for common goods. Additionally, inflation has a latency effect. When my mother complains about the rising prices of grocery items and foods, like eggs and vegetables, I know that we have already sunk into high inflation for a while.

The Federal Fund rate holds significant influence over inflation. With a high funds rate, the opportunity cost of lending money increases. We always need to earn profit for lending money for others. We will not lend money to others if the interest is lower than lending to the Fed because of the opportunity cost. When the Federal Reserve increases the federal funds rate, we have to pay a higher price for borrowing money.

The higher opportunity cost leads to higher interest rates on loans, discouraging our daily spending and increasing business investment. "Winter is coming." We often hear news of layoffs, difficulties in getting jobs, and challenges in financing. The reason behind these issues is that the Fed attracts money from the global market into its funds. Individuals and organizations are often more inclined to invest in Fed funds for the high fixed returns with no risk.

As spending slows down, demand for goods and services decreases, which can help curb inflation.

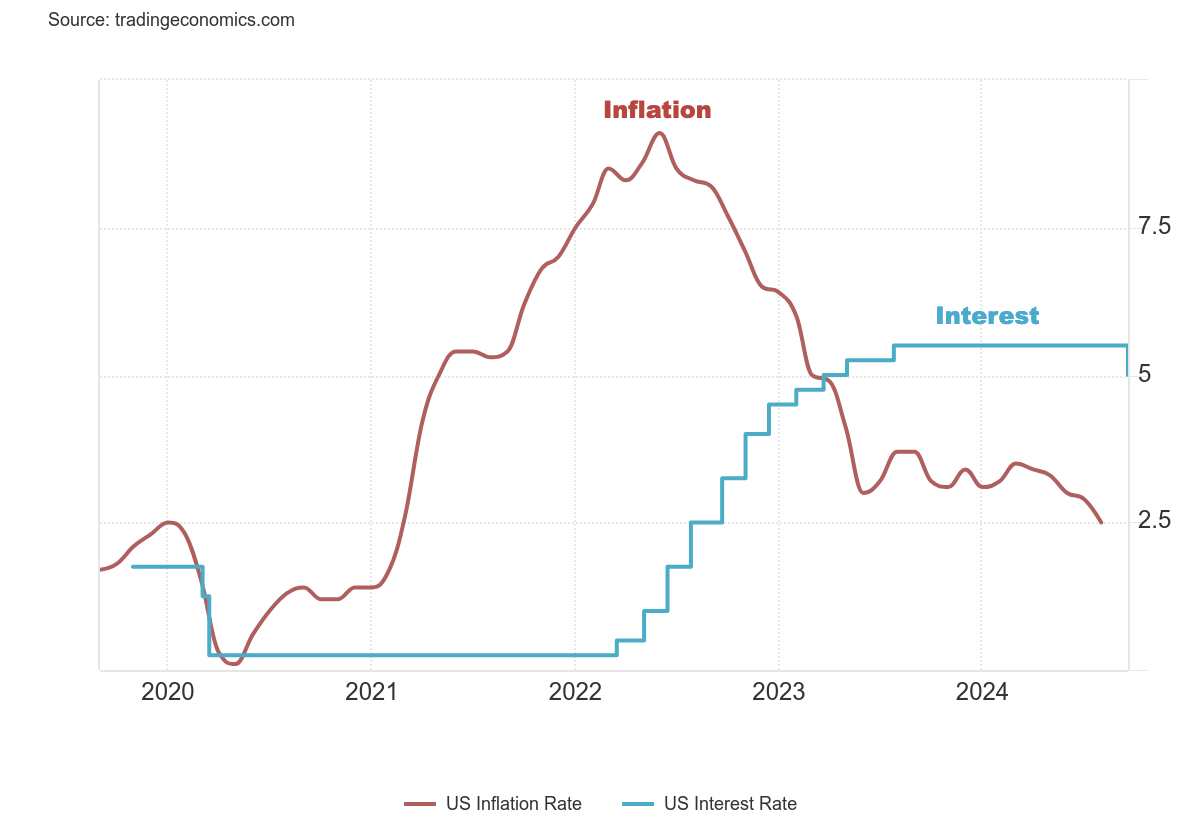

"Inflation has eased substantially from a peak of 7 percent to an estimated 2.2 percent as of August". said by Powell

From the chart of the US inflation rate versus the Federal Funds rate, we can see the influence of increasing fund interest rates on decreasing inflation. The goal of achieving stable prices is met through high interest rates.

Consequence of high Fed Funds interests rate

After the slowing down of spending power and demand, the market becomes cold. The people around me refuse to part with their cash. There is a chill in the air, even for businesses. Many are either reducing output or laying off employees, thereby creating a spiral of downturn. Entrepreneurs and companies that were once eager to launch new ventures are now hesitating, fearing that the climate won’t support their ambitions. Even large companies are pulling back, prioritizing savings over innovation. People lose confidence in the market, and the market loses confidence.

As confidence erodes, businesses suffer, and ultimately, we all bear the consequences. Without consumer trust, businesses struggle to drive growth and secure financing. Investors become wary, pulling back from funding new ventures. This lack of momentum creates a cycle where businesses can’t hire, invest, or improve their offerings, leading to a stagnating economy.

Hence, as the inflation rate returns to an acceptable level, it is time to break the cycle. The Federal Reserve finally cut the interest rate by 50 bps to the range of 4.75%–5% on September 19, 2024.

What's next?

"We know that reducing policy restraint too quickly could hinder progress on inflation."

Optimally, the Federal Funds rate will continue to decrease, which would help motivate the market to warm back up. However, the inflation has potential to return. How to balance between the inflation and needs of market growth is crucial.

After a period of increasing inflation, when the inflation rate begins to decrease, it can signal the onset of potential recessionary pressures or economic risks.

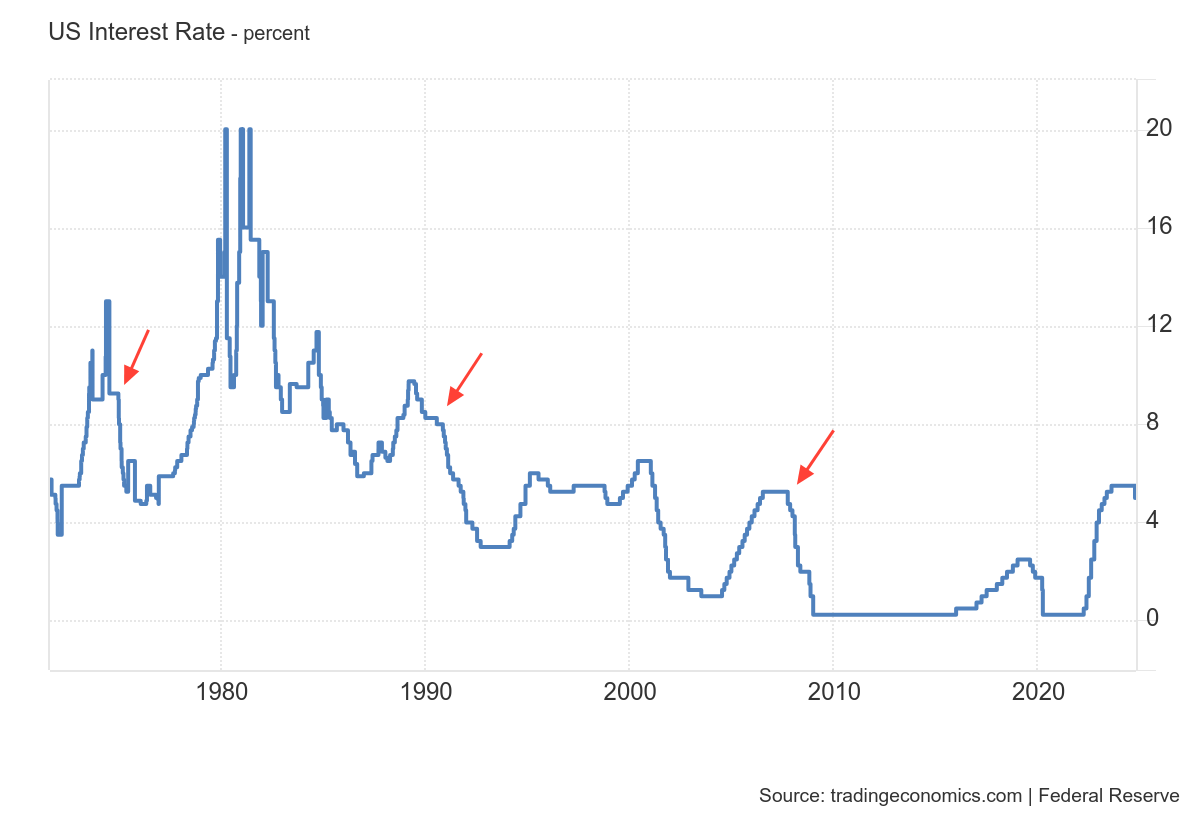

From history, the world experiences the U.S. stagflation of the 1970s, the Japanese economic bubble burst in 1990, and the global financial crisis of 2007-2008, all of which illustrate the complex relationship between inflation and economic stability.

The 50 bps cut may not be the end of increasing interest rates and could potentially lead to a global recession. But how?

Comments ()